Back

Connect

Back

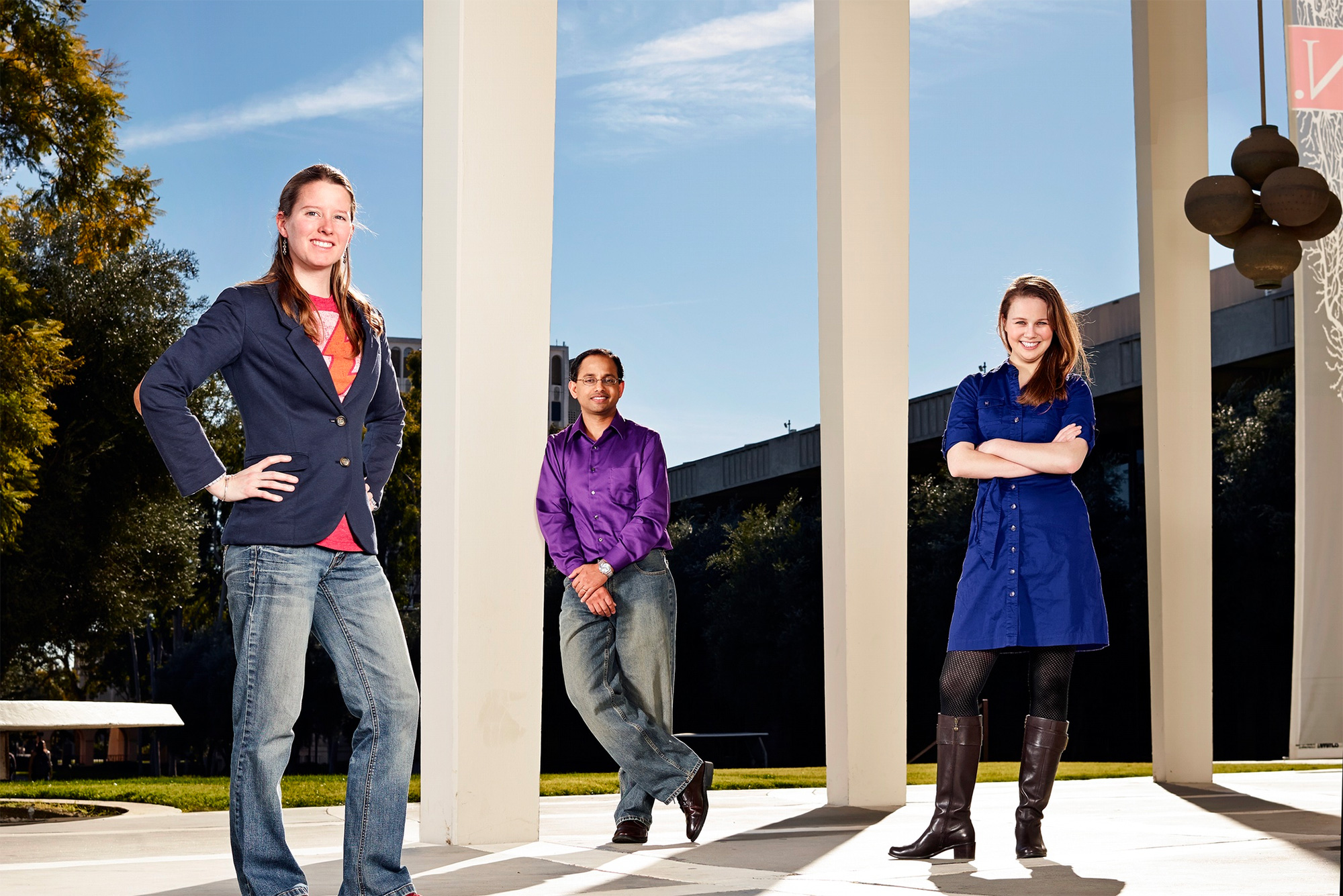

To ensure the success and well-being of every member of the Caltech alumni community.

To advance humanity through active alumni participation in the Caltech community and in the communities in which we live, work, and play.

Alumni liking what they do each day and being motivated to achieve their goals

Alumni having strong and supportive relationships and love in their life

Alumni effectively managing their economic life to reduce stress and increase security

Alumni engaged in the areas where they live, liking where they live, and feeling safe and having pride in their community

Alumni having good health and enough energy to get things done on a daily basis

Adapted using Gallup’s research on well-being.

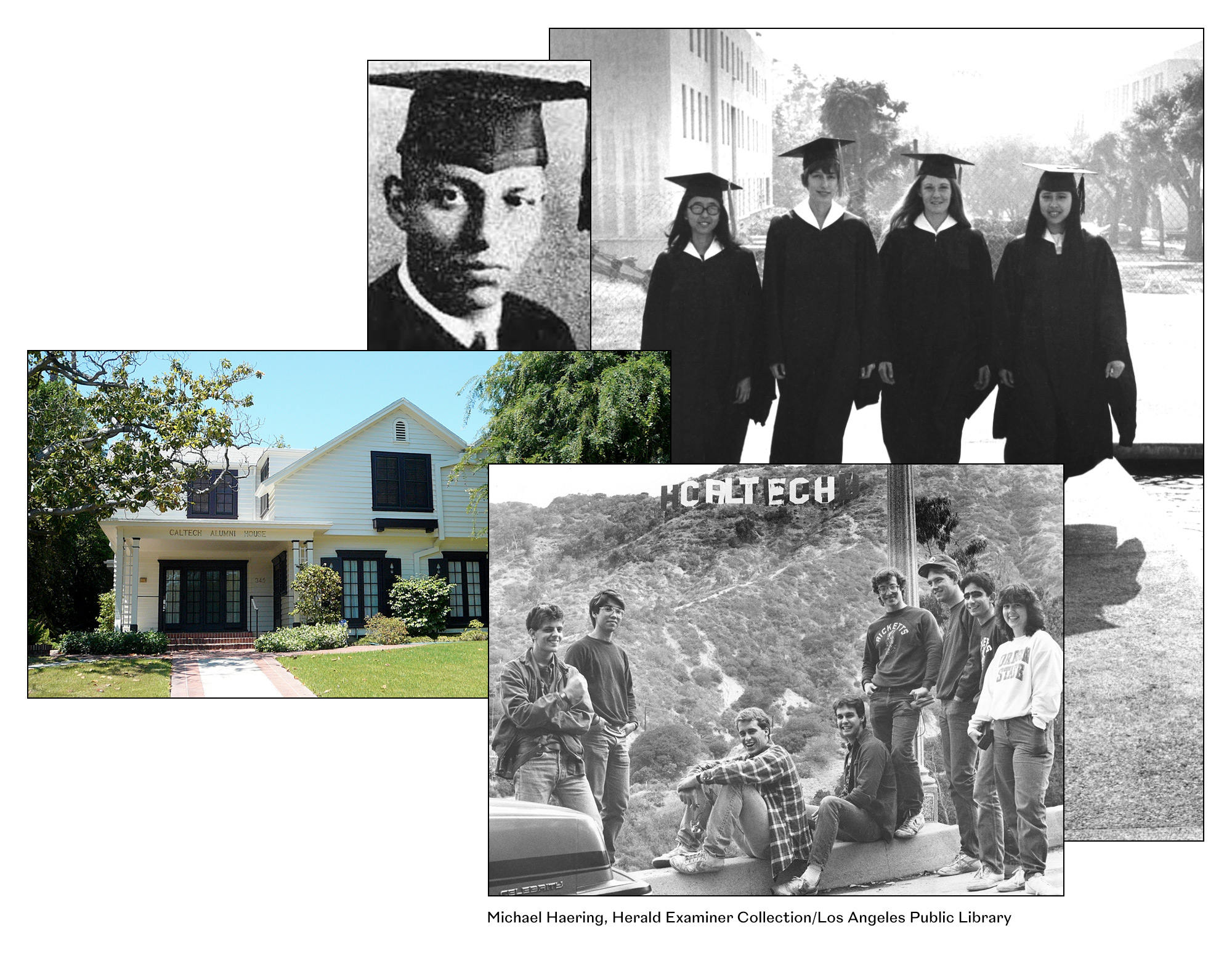

An alumni association was formed in 1897, one year after the first BA degrees were awarded to graduates of Throop Polytechnic Institute. The history of this association carried forward to June 7, 1915, when thirteen graduates of what had become Throop College of Technology banded together to form an alumni association for the purpose of creating a perpetual bond of friendship between all alumni. The name of the college was changed to the California Institute of Technology in 1920.

In 1935 the Caltech Alumni Association was formally incorporated in the State of California, and its purposes were expanded to assist the Institute by supporting and advancing the cause of higher education. The Articles of Incorporation were amended in 1968 to expand the purposes of the Association and to increase the number of directors. In 2001, the corporation was converted from a "mutual benefit corporation" to a "public benefit corporation" under California law, and it was determined by the Internal Revenue Service to qualify as a tax-exempt 501(c)(3) organization.